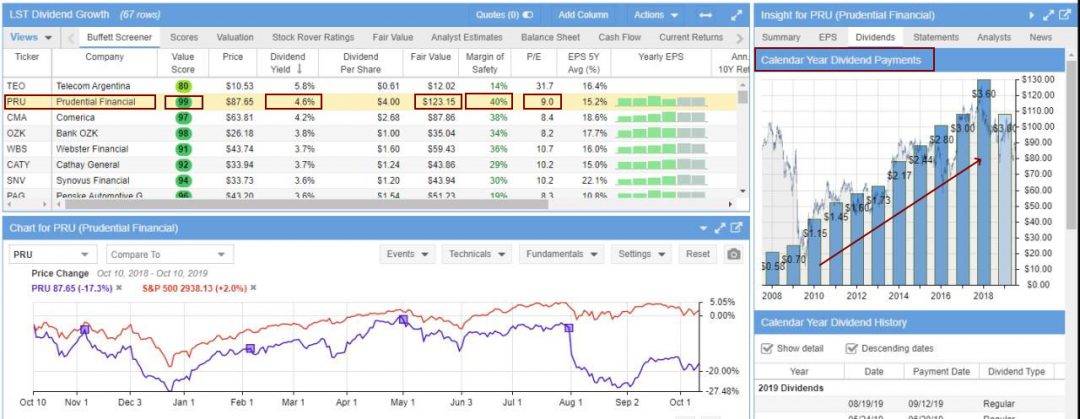

On the other hand, technical stock screeners are optional for day traders, swing traders, trend followers, breakout traders, and others who use charts and tend to hold stock only for the short term. Fundamental stock screeners will be best for value investors, GARP investors, dividend investors, and other investors who are willing to hold stocks for the medium to long term. CriteriaĪll stock screeners in this post will be sorted into two groups: Fundamental and Technical. Thus, these screeners are of no use to me, as they cannot find the stocks I need for my trading strategy. This is because they don’t offer sufficient technical screening criteria to choose from. However, I found these tools fail to match premium third-party tools, especially if you have a specific strategy based on technical analysis. All my brokerages, Interactive Brokers, Saxo Bank, and Charles Schwab, provide decent tools to screen stocks for free. Some premium brokerages provide built-in stock screeners on their trading platform. Hence, I would say paid stock screeners are 100% worth it.

However, you will gain access to top-notch tools that can help you make money from the market many times your subscription fees. This is why paid stock screeners are superior.Ĭertainly, you will need to invest some money in it. Premium stock screeners have very few or none of these limitations. Few features to support comprehensive research.Thus, the data is not tradable (not usable for day traders) Free stock screeners never provide real-time data.

/stockscrenersfordaytraders-593ee6333df78c537b76c4d3.jpg)

For example, some screeners only cover large-cap stocks, not small ones in the Russell 2000 index. Very few data points and filter criteria for effective stock screening.However, all free stock screeners have significant limitations and drawbacks, including but not limited to the following: I could say using free stock screeners is not optimal. You may choose to keep using the free stock scanner, and avoid investing your money in paid tools.Īs a techno-fundamental investor, I have used numerous tools from both categories. If you are new to stock screening, you may not know which one is the most suitable tool for your investment strategy. Other Alternatives Things You Should Knowīelow are essential points that I believe you should know before choosing a suitable stock screener for your trading and investing career.

Thus, all stock market participants can handily choose the one that suits their investing or trading style.

This post will feature the best paid stock screeners available in the market. I decided to do the heavy lifting for you. However, finding an excellent tool or an application from such a colossal marketplace becomes highly challenging. Thus, there are tons of paid stock screeners available in the market. Unsurprisingly, stock screeners are a boon for traders and investors, as they save hours of their valuable time in the research process.Ĭurrently, many companies have created several tools and applications for that purpose. It increases the efficiency of search and reduces the time and labor needed to scan the entire stock market manually. Hence, numerous investors and traders alike miss such lucrative opportunities that can grow their money in many folds.Īn excellent stock screener is much needed.Ī stock screener works as a search engine that filters the stock with the necessary conditions. With thousands of stocks in the market, finding the right one to purchase at the right time can be troublesome. All major indexes all skyrocket to new highs. Since the end of the Great Recession in 2009, stocks have become one of the most popular investment assets amongst investors and traders worldwide. It’s no surprise that the stock market is getting more attention than ever.

0 kommentar(er)

0 kommentar(er)